Unseasonable Weather Still Weighing on the Economy

The latest edition of the Federal Reserve’s (Fed) Beige Book, released on July 17, 2013, described the economy as increasing at a modest-to- moderate pace, with little wage or inflation pressures. Housing and commercial real estate were mentioned as key drivers of growth. The report, along with comments made by Fed Chairman Ben Bernanke at his semi-annual Monetary Policy Testimony to Congress last week (July 15 – 19), suggest that the Fed is still on track to begin scaling back its quantitative easing (QE) program this fall, but that it remains a long way from tightening monetary policy by raising its fed funds rate target.

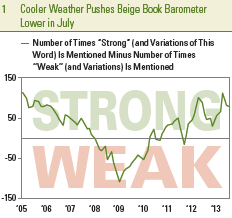

In order to provide one snapshot of the entire Beige Book collage of data, we created our proprietary Beige Book Barometer (BBB) [Figure 1]. The barometer ticked down to +79 in July 2013, from +82 last month. The April 2013 reading was +112. Despite the downtick since April, the BBB remains well above its Superstorm Sandy-related dip to +30 in November 2012. Note that the April 2013 reading (+112) was both a post-Great Recession high and also the highest reading since 2005, suggesting a broadening and deepening of the economic expansion. The move down to +79 from +112 between the April and July 2013 editions of the Beige Books came as the number of positive words dropped and the number of negative words hit a fresh seven year low in July 2013. The drop in the number of negative words in the Beige Book to a seven-year low can be viewed as reflecting the diminishing pace of headwinds (e.g., fiscal policy, Europe, China, housing) that have hampered the U.S. economic recovery over the past four years.

Our BBB, a diffusion index that measures the number of times the word “strong” or its variations (stronger, strength, strengthen, etc.) appear in the Beige Book less the number of times the word “weak” or its variations (weaken, weaker, etc.) appear, is displayed in Figure 1. The barometer is an easy-to-use, quantitative way to derive the shades between strong and weak in the predominately qualitative Beige Book report.

Headwinds From Fiscal Policy Diminish

The word “fiscal” appeared just four times in the latest Beige Book, down from five in June 2013, and 12 in April. There were 17 mentions in the March 2013 Beige Book, and a whopping 38 in the January 2013 edition. Because of the timing of the collection of comments for the January 2013 Beige Book (comments from contacts in the business and banking community were collected throughout December 2012 and during the first few days of January 2013), we noted that with 38 mentions of the word “fiscal,” the January 2013 Beige Book likely overstated the impact of the fiscal cliff on economic activity in early 2013.

At the start of 2013, as Congress passed legislation to avoid the worst case scenario of the fiscal cliff, but allowed the sequester (i.e., government spending cuts prescribed in the debt ceiling agreement reached in 2011) to proceed, we expected that the word “sequester” would start to appear more often in the Beige Book. Thus far, however, that has not been the case. The word sequester was not used at all in the latest two Beige Books (July and June 2013) and appeared just once in the April 2013 Beige Book. Mentions of budget or budget cuts have been almost non-existent in the recent Beige Books as well. Looking ahead, we still expect the word sequester (or related words) to show up in the next several Beige Books, but with the debt ceiling debate and possible government shutdown now pushed back until late 2013, fiscal uncertainty outside of the impact of the sequester will likely continue to fade in upcoming Beige Books. The peak of the impact of the sequester will likely be felt in the recently completed second quarter and third (current) quarter of 2013.

Word Clouds Show Unseasonably Cool Weather and Growing Concern About Impact of Health Care Reform Still Acting as Headwinds

The word clouds in Figure 3 are dominated by words describing the tone of the economy when the Beige Books were published. Below are some observations on the current Beige Book (released on July 17, 2013) relative to other recent editions of the Beige Book.

- In the last two Beige Books (June and July 2013), the word “weather” appeared a total of 43 times, 27 times in the June 2013 edition of the Beige Book, and 16 times in the July 2013 version. The 43 mentions were nearly double the 24 mentions of weather in the same two Beige Books in June and July 2012. All but a few of the mentions of weather in the last two (June and July 2013) were in a negative context. The words rain, wet, cool, and cold appeared a total of 22 times in the June and July 2013 Beige Books. These words did not appear at all in the June and July 2012 Beige Books. This helps to explain, in part, the poor U.S. economic data reports — both on an absolute basis and relative to expectations — for much of the spring (March, April, May, and early June), especially in housing. In corporate earnings reports for the second quarter (April, May, and June 2013), managements in the housing construction, lodging, and leisure and hospitality industries have also mentioned unseasonably cold and wet weather as having a negative impact on results. The key takeaway here is that a return to “normal” weather could provide a significant lift to weather-sensitive portions of the economy and to upcoming readings on our BBB. Indeed, the first three weeks of July 2013 have generally seen warmer-than-usual temperatures and less-than-usual amounts of rainfall across the nation.

- In the Beige Books released in late November 2012 and early January 2013, economic uncertainty surrounding the fiscal cliff and the rebound from the economic disruption wrought by Superstorm Sandy dominated. Sandy and the fiscal cliff have since faded as concerns, and uncertainty has faded a bit as well. There were just seven mentions of the word “uncertain” in the July 2013 Beige Book, down from 13 in the June Beige Book. It was used 26 times in March 2013, and 43 in January 2013. The seven mentions of uncertain in the June 2013 Beige Book were the fewest since June 2011.

- The word “confidence” appeared just nine times in the latest Beige Book, 10 times in the June 2013 Beige Book, seven times in the April 2013 Beige Book, and 11 times in the March 2013 Beige Book. However, unlike in 2011 and most of 2012, when the word was used in a negative context (i.e., lack of confidence, weak confidence), most of the mentions of the word confidence in the Beige Book have been in a positive context. Eight of the nine mentions in July, nine of the 10 mentions in June, five of the seven mentions in April, and nine of the 11 mentions in the March 2013 Beige Book were in a positive context. Thus, over the past few Beige Books since Superstorm Sandy, business and banking contacts have generally become more confident in the recovery, especially in housing. This suggests that a sustained, multi-year recovery in the housing market is likely underway.

- Although the number of mentions of “health care,” “health insurance,” and the “Affordable Care Act” (ACA) totaled just 15 in the latest Beige Book, heath care remains a major issue for Main Street as the ACA begins to be implemented. Health care, health insurance, and the Affordable Care Act were mentioned 28 times in June 2013, 26 times in April, and 18 times in the March 2013 Beige Book. The topic warranted just eight mentions in the January 2013 Beige Book. In contrast, those words were found just a handful of times in the Beige Book released a year ago (June and July 2012). We will continue to monitor these health care words closely in the upcoming Beige Books, as the economy continues to adjust to the impact of the ACA. We expect this set of words to grow in importance in the coming months.

- There were just three mentions of Europe in the latest Beige Book, down from eight mentions in the June 2013 Beige Book. Europe was mentioned nine times in the April 2013 edition of the Beige Book. The three mentions of Europe in July 2013 were the fewest since October 2012, and well below the 15 – 20 mentions seen in the summer and fall of 2012, as Europe struggled through elections in Greece and increased fears of a break-up. Not surprisingly, nearly all of the mentions of Europe in the latest Beige Book were in a negative context. Perhaps business and banking contacts on Main Street are not as exposed to Europe as some of the larger businesses and financial institutions on Wall Street are that dominate media coverage. But it is also worth noting that the European debt crisis is well into its fourth year, and Main Street may be getting used to it now. The relatively few mentions of Europe are consistent with our view that the European economy has probably stopped getting worse, even though it may not accelerate anytime soon.

- Despite the well-publicized slowdown in China’s economy in the second quarter of 2013, the concerns around an overheated Chinese property market, and a sudden rise in overnight borrowing costs in China, China warranted just two mentions in the latest Beige Book, down from three mentions each in the April and June 2013 Beige Books. The Beige Book suggests that while China has not entirely disappeared from Main Street’s radar, it is far less of a concern than the media makes it out to be. Indeed, the last time China warranted as many as six mentions in the Beige Book was in January 2012, as fears of a “hard landing” in China began to gather steam. The Chinese economy appeared to have bottomed out in late 2012, avoiding a “hard landing,” but recent data in China suggest that it has not re-accelerated as quickly as some market participants hoped.

___________________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Quantitative easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System, is charged under the United States law with overseeing the nation’s open market operations (i.e., the Fed’s buying and selling of United States Treasure securities).

_____________________________________________________________________________________________________________________________________

INDEX DESCRIPTIONS

Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.