The LPL Financial Research Outlook 2014 comes out next week, so this week is a great opportunity to take a shorter-term look at the rest of 2013. It has been an amazing year for stock market investors with the strongest gain in a decade and a record for the annual outperformance of stocks over bonds, measured by the S&P 500 Index and the Barclays Aggregate Bond Index since its inception in 1976. But it may get even better. After all, November marks the turn in the calendar to what has been the best six months of the year for equity markets, on average, following the weakest six-month period from May to October, whose start is marked by the adage, “Sell in May and go away.” In fact, the S&P 500 has been up 20% by the start of November seven times since WWII. Every time, the index has always added to those gains — by an average of 6%.

What may drive additional gains? The market will focus on several things: holiday shopping, seasonal patterns, and the December Federal Reserve (Fed) meeting.

Holiday Shopping

As Black Friday approaches, market participants turn their attention to holiday shopping as a barometer of the health of the economy and as an indicator for potential leadership by the companies in the consumer discretionary sector.

The National Retail Federation projects 2013 holiday sales to rise 3.9% this year, slightly ahead of last year’s 3.5% increase. We believe this expectation for a close-to-average year holiday sales have increased 3.3%, on average, for the last 10 years) will likely be exceeded for a few reasons:

-

The wealth effect. History shows that this year’s gain for the S&P 500 suggests a high-single-digit gain for retail sales [Figure 1]. When people feel wealthier, they tend to spend more. Adding to this wealth effect, home prices are up double digits too.

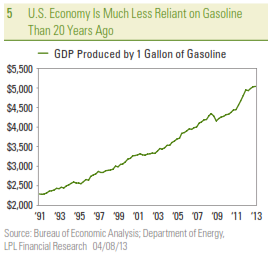

- More discretionary income. Gasoline prices are down by about 5 – 10% from last year, and 1.3 million more people have full-time jobs than a year ago, according to the Bureau of Labor Statistics.

- Fading drags. We are starting to see a rebound in weekly retail sales from the shutdown-induced stall in October. And the year-over-year comparisons will benefit from the November 2012 impact of Superstorm Sandy.

Seasonal Patterns

End-of-year seasonal patterns are frequently a focus of market participants due to the tendency of fund managers and individuals to tidy up portfolios for tax and other reasons around year end. However, there is not likely to be much tax loss selling this year, given the broad and powerful gains, but we can expect a lot of capital gains distributions from funds that could prompt some volatility.

The “January effect” of outperformance by smaller company stocks has tended to start in mid-December in recent years after they have been dumped for tax loss selling and other reasons.

But what may lead the market higher? Based on the above analysis, it could be the consumer discretionary sector. This sector typically has a pretty consistent pattern of outperformance in November and December. The industrials sector also tends to outperform historically, while financials and energy tend to lag.

Fed Meeting

The Fed meeting on December 17 – 18 may be the biggest event during the rest of 2013, and it will be closely watched by market participants. Although it is a long shot that the Fed will announce tapering its bond-buying program at that meeting, the statement, accompanying economic projections, and press conference will be scrutinized for insights regarding whether tapering will begin in January, March, or beyond.

Bond yields may rise in response to improving economic data ahead of the meeting, continuing the slow-but-steady rise in yield from the 2.5% on the 10-year Treasury seen in late October. However, we are unlikely to see a sharp rise that would have a strong negative impact on the stock market.

A Strong Close

A strong close to a strong year may be in store for stocks. A pass on tapering by the Fed may boost stocks headed into year-end, meaning the S&P 500 finishes the year with a “Santa Claus rally” — the tendency for the stock market to post gains between Christmas and New Year’s Day, a period that has averaged a 1.5% return since WWII.

______________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock and mutual fund investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise and bonds are subject to availability and change in price.

The Consumer Discretionary Sector: Companies that tend to be the most sensitive to economic cycles. Its manufacturing segment includes automotive, household durable goods, textiles and apparel, and leisure equipment. The service segment includes hotels, restaurants and other leisure facilities, media production and services, consumer retailing and services, and education services.

Energy Sector: Companies whose businesses are dominated by either of the following activities: The construction or provision of oil rigs, drilling equipment and other energy-related service and equipment, including seismic data collection. The exploration, production, marketing, refining and/or transportation of oil and gas products, coal and consumable fuels.

Financials Sector: Companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, insurance and investment, and real estate, including REITs.

Industrials Sector: Companies whose businesses manufacture and distribute capital goods, including aerospace and defense, construction, engineering and building products, electrical equipment and industrial machinery. Provide commercial services and supplies, including printing, employment, environmental and office services. Provide transportation services, including airlines, couriers, marine, road and rail, and transportation infrastructure.

______________________________________________________________________________________________________________________________

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays Capital U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

______________________________________________________________________________________________________________________________

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC