The Federal Reserve (Fed) reintroduced interest rate risk in the bond market

last week. Corporate bonds, particularly lower-rated high-yield bonds,

weathered the rise in rates better than most sectors. Bond prices overall

are generally higher so far in 2014, and high-yield bonds remain expensive

relative to history, but that does not mean that the sector cannot still offer

value for investors. Credit quality is generally good, funding conditions are

favorable, and defaults may remain low — all of which support higher-than average

valuations. High-yield bond valuations must also be taken in the

context of a bond market with limited opportunities. High-yield bonds and

lower-rated debt may still offer attractive opportunities in the bond market.

The earnings reporting season for the fourth quarter of 2013 (with

results released over the first quarter of 2014) broadly showed that the

fundamentals underlying corporate America remain strong. Fourth quarter

earnings increased by nearly 10% on an annualized basis, an acceleration

versus the third quarter of 2013 and an improvement from the mid-single digit

pace of the prior several quarters. Revenue growth improved at a much

more modest 1.0% annualized growth rate but is still supportive of good

credit metrics underlying corporate bonds. Please see the discussion below

for a closer look at these important indicators of corporate credit quality.

Good credit quality metrics and low defaults may help support corporate bond

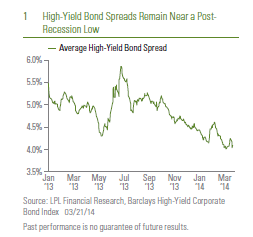

valuations in 2014 — a trend that may continue. However, the combination

has led to the lowest yield advantage, or spread, of high-yield bonds relative

to Treasuries since the end of the financial crisis [Figure 1]. The lower (or

narrower) the yield spread, the more expensive the valuation. The current

average yield spread of 4% is below the 5.8% long-term average.

It is not uncommon for high-yield spreads to stay narrow for an extended

time. After a period of improving credit quality, the gains achieved by

corporate bond issuers have lasting impacts leading to long periods

of stable credit quality [Figure 2]. In a typical credit cycle, as credit

quality weakens and/or default risks increase, usually in response to a

weakening economy, yield spreads widen and high-yield bonds historically

underperform as investors demand greater yield compensation. Once the

economy rebounds, yield spreads contract as credit quality improves and

risks subside. At a certain point, additional credit quality improvements are

difficult to achieve, and credit quality merely remains stable.

Periods of stable credit quality can persist for years. Stability persisted for

approximately six years during the 1990s and nearly four years in the past

decade (2000 – 09). Note that the average high-yield spread narrowed to

3% or below at prior high-yield bond market peaks, more than a percentage

point below the current level. While we do not think such a narrow yield

spread can be achieved in the current cycle due to the lower level of overall

interest rates, the current level of yield spreads may persist for most of 2014

and perhaps beyond.

Credit Quality

Using data from the Fed’s Flow of Funds database, we can take a closer

look at broad corporate credit quality metrics for non-financial corporations

that may help reveal whether the stable portion of the credit cycle may be

approaching an end. The degree of financial leverage, measured by the

amount of debt relative to corporate profits, among corporate bond issuers

is a focal measure for investors, since highly leveraged corporations are

more likely to default and may cause corporate bond prices, especially high yield

bond prices, to rise. The current level is below peaks witnessed during

the past several recessions (early 90s, early 2000s, 2007 – 09) but is on the

rise, which is a negative for corporate bond investors even though corporate

profits are at all-time highs [Figure 3].

But looking at leverage alone does not reveal the whole picture. The cost to

service that debt is important and quite manageable [Figure 4]. Non-financial

corporations can cover their interest payment obligations several times over.

Although interest coverage metrics have likely plateaued, it still indicates a

substantial ability for the timely payment of interest income to investors.

Financial regulation has forced banks to bolster bank balance sheets, and

financial system leverage, as measured by the market value of their equity

relative to assets, remains low [Figure 5]

Leading Indicators

Aside from credit quality, funding conditions generally remain healthy. The

ability to obtain funding at a critical juncture can override credit quality

metrics — either good or bad. The Fed’s Senior Loan Officer Survey reveals

the percentage of banks that are either tightening or loosening lending

standards. The survey can be a leading indicator of defaults [Figure 6], which

in turn can have a dramatic impact on high-yield bond valuations. Thanks to

an expanding economy, most banks are easing lending standards as they

compete to win new loan business, which should help keep defaults low.

On the negative side, the desire for yield in a low-yield environment has

led to companies issuing debt with weaker investor protections, known as

covenants. Since late 2013, Moody’s rating agency has reported several

times that covenant protections are near historic lows based upon their

proprietary rating scale. Poorly underwritten new bond structures do

not immediately impact the high-yield bond market and usually require a

catalyst. Still, weak covenants and more speculative issuance can sow the

seeds of a future rise in defaults and a decline in high-yield bond prices.

The timing of such an event is difficult to predict but historically occurs

from months to years after such a surge and depends on the health of the

economy as well as the ease of obtaining funding in the marketplace.

Conclusion

News of corporate bond defaults in China has caused some investors to

refocus attention on elevated high-yield bond valuations here in the United

States. But China’s issues are unique and a result of its own debt bubble,

fueled by speculative deals often backed by commodities. Domestic high-

yield bond valuations, on the other hand, remain high for a reason — backed

by good credit quality and low defaults, both may continue and should help

support the sector. An increase in more speculative issuance may pose a

future risk but does not override current investment merits. An expanding

economy and easier lending standards provide an additional boost. With

bond market valuations still broadly expensive, the added yield of high-yield

bonds will likely enable the sector to be one of the more attractive options

for investors in 2014.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific

advice or recommendations for any individual. To determine which investment(s) may be appropriate for you,

consult your financial advisor prior to investing. All performance reference is historical and is no guarantee

of future results. All indices are unmanaged and cannot be invested into directly. Unmanaged index returns

do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of

any investment.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you

discuss your specific tax issues with a qualified tax advisor.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no

guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline

as interest rates rise, and bonds are subject to availability and change in price.

The Fed funds rate is the interest rate on loans by the Fed to banks to meet reserve requirements.

Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of

principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However,

the value of fund shares is not guaranteed and will fluctuate.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher

interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a

diversified portfolio for sophisticated investors.

Bank loans are loans issued by below investment grade companies for short term funding purposes with

higher yield than short-term debt and involve interest rate, credit/default and liquidity risk.

INDEX DESCRIPTIONS

The Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment grade, fixedrate,

taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s,

Fitch, and S&P is Ba1/BB+/BB+ or below. The index excludes Emerging Markets debt. The index was

created in 1986, with index history backfilled to January 1, 1983. The U.S. Corporate High Yield Index is part

of the U.S. Universal and Global High Yield Indices.

The Barclays Municipal Bond Index is a market capitalization-weighted index of investment-grade municipal

bonds with maturities of at least one year.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is

not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC