Several key reports on the state of the housing market are due out this week (February 24 – 28, 2014), most of which will likely be negatively impacted by the colder and snowier-than-usual weather in much of the nation over December 2013 and January 2014. The data due this week include:

- Case-Shiller Home Price Index for December 2013;

- New Home Sales for January 2014;

- Pending Home Sales for January 2014; and

- Housing Contribution to gross domestic product (GDP) for Q4 2013.

The weather will eventually return to normal, but market participants are likely to be asking: Once the weather improves, will the housing data continue to feel the pinch of higher mortgage rates over the rest of 2014?

Solid Supports

The recent rise in mortgage rates — from just under 3.50% (for a conventional 30-year loan) in May 2013 to a recent reading of just over 4.25% — has led to widespread fears that the housing recovery will come to a grinding halt. Those fears appear to be overdone, in our view, as almost all of the factors supporting an ongoing recovery in housing remain in place. However, the rise in rates will likely slow the pace of the recovery somewhat.

In general, the housing market hit bottom in early 2009, and moved sideways between early 2009 and late 2011 before picking up momentum at the start of 2012 (please see “Location, Location, Location”). Until housing added 0.3 percentage points to overall GDP in 2012, housing construction (the most direct way housing impacts economic growth as measured by GDP) had not been a significant, sustained contributor to economic growth since 2005. The lack of participation from housing has been one of the main reasons for the sluggish economic recovery, along with the severe cutbacks in state and local governments.

When we last wrote in depth on the housing market in mid-2013, we forecast that “despite the recent rapid rise in rates, we still see housing making another significant (0.3 – 0.5 percentage points) contribution to GDP growth in 2013, as the positives driving the residential recovery more than outweigh the negatives.” Indeed, although the data are not final, housing contributed 0.3 percentage points to overall GDP growth in 2013. We expect housing to add between 0.2 and 0.3 percentage points to overall GDP growth in 2014.

At this stage of the recovery, satisfying pent-up demand for housing rather than mortgage rates will likely be the bigger driver of housing. Later on, when the pent-up demand is sated, interest rates (and affordability) should be key drivers, along with housing supply and demand, the willingness of banks and financial institutions to make mortgage loans, the health of the labor market, and the housing PE (median sales price/disposable median income per capita).

Although we continue to hear and read comments from housing market “bears” that the housing market is already back in a “bubble,” housing (represented by residential investment) currently accounts for just 3% of GDP. This is half of what it was at the peak of the housing market in 2005 – 06, when housing accounted for more than 6% of GDP. Since 1980, housing, on average, has accounted for 5% of GDP. At just 3% today, housing’s share of GDP is not only half of the recent peak, but also well below the long-term average of 5%. But what about the other housing indicators?

Key Housing Indicators

Many, if not all, of the other housing indicators we watch (see below) also suggest ongoing recovery in the housing market in the quarters and years to come.

To be sure, while the sharp increase in mortgage rates since mid-May 2013 may have slowed the pace of gains in the U.S. housing market, our view remains that the housing market is still in the early stages of recovering from the 2006 – 09 bust that followed the decade-and-a-half (early 1990s through mid-2000s) housing boom that began to show severe cracks in 2007 and collapsed in 2008. The collapse in housing, in turn, was a major contributor to the financial crisis and the Great Recession of 2007 – 09. The housing market, along with many financial markets and global economies, is still feeling the after-effects of the housing collapse.

The health of the housing market can be measured in many direct ways (e.g., housing starts, housing sales, construction spending, home prices) and indirect ways (e.g., homebuilder sentiment, mortgage applications, foreclosures, inventories of unsold homes, mortgage rates, housing vacancies, lumber prices, prices of publicly traded homebuilders). The U.S. government and private sources collect and disseminate these data. A quick recap of some of these indicators is below.

Taking the Pulse of the Residential Recovery

-

Near-record housing affordability. Housing affordability, the ability of a household with the median income to afford the payments on a median priced house at prevailing mortgage rates, hit an all-time high in early 2013 before the big run-up in mortgage rates that began in mid-May 2013. The latest data point (December 2013) saw a 21% drop in affordability from the peak in January 2013. Despite the drop, affordability remains well above the long-term average, and it is some 70% higher than at the peak of the housing market in late 2005/early 2006. Rising incomes and the aftermath of the 20 – 30% drop in home prices nationwide between 2005 and 2009 will continue to support an elevated level of affordability. At this point in the housing recovery, pent-up demand will likely outweigh affordability as the main driver of housing demand.

-

The housing PE. Although not a perfect measure of the frothiness (or lack thereof) in the housing market, the ratio of the median sales price of an existing home ($197,700 in December 2013) to disposable personal income per capita ($39,726 as of December 2013) is one way to gauge the health of the market. Our infographic shows that while the housing PE”has moved higher in recent months, it remains well below average. Indeed, aside from the housing bust era (2007 – 11), the housing PE is the lowest it has been in more than four decades. This also suggests that the housing recovery remains in its early stages and is not in a bubble.

-

Inventories of unsold homes are tight. Although the inventory of unsold new and existing homes has moved up from a 32-year low since the start of 2013, inventories of unsold homes remain well below average. The official count of the inventory of unsold single-family existing homes (from the National Association of Realtors), along with the record-low inventory of new homes for sale, tells us 1.8 million homes are for sale. Depending on the data source cited (there is no “official” number for shadow inventory), the shadow inventory is in the 1.0 – 1.5 million range. The low inventory of unsold homes, particularly in areas where housing demand is the highest, supports ongoing improvement in housing construction and housing sales.

-

Supply of home mortgages. From the mid-1990s through late 2006, bank lending standards (down payment required, credit scores, work history, etc.) for residential mortgages were relatively easy. Coupled with low rates and rapid innovation in financial products backing residential mortgages, this easy credit helped to fuel the housing boom. The banking industry began tightening lending standards in early 2007, and continued to tighten for more than two years. Lending standards eased in 2009 and 2010, but remained more restrictive than they were in the peak boom years from 2004 to 2006. The latest survey (February 2014) reveals that bank lending standards for home mortgages are now back to “normal,” as defined by the 10 years between 1995 and 2005. It’s too soon to tell whether or not the tightening of standards in the latest period (February 2014) is the start of a new trend, or just a wiggle in the data. Either way, relatively normal mortgage lending standards are supportive of more gains in housing in the coming quarters. The Federal Reserve (Fed) compiles these data in the quarterly Senior Loan Officer Survey.

-

Demand for home mortgages. Consumer demand for mortgages remained muted during the first two-and-a-half years (early 2009 through late 2011) of the housing recovery, as consumers remained uncertain about prospects for home price appreciation and their own financial and labor market status. Between mid-2011 and mid-2013, an improving labor market, Fed actions to lower mortgage rates, and rising home prices drove consumer demand for mortgages to levels not seen since the early 2000s. But the rise in mortgage rates since mid-2013 has had a meaningful impact on demand for mortgage loans in recent quarters, and a further pullback in consumer demand for mortgages would be a threat to the sustainability of the recovery. The housing recovery is dependent upon low interest rates, but not necessarily the lowest interest rates. History shows us that if job and income growth can rise along with mortgage rates, the growth in housing can continue. The Fed compiles these data in the quarterly Senior Loan Officer Survey.

-

Demand for housing. Net household formation boomed in the mid- 2000s (2004, 2005, and 2006) but began to slow just prior to the start of the Great Recession in 2007. Unemployed new graduates were living with their parents or renting in large groups rather than moving into homes of their own for years after the 2007 – 09 recession. But that is ending. Over the past five years, (2009 – 13) household formations have stabilized, partially due to the better labor market, but also thanks to the echo boomers reaching their mid-to-late 20s. Although new household formation has slowed from its pre-Great Recession pace, it is still running at almost 1.0% per year. By early 2011, the gap between new household formation and new housing starts had never been wider. Soon thereafter, housing starts began to recover, and the healing in the housing market began to accelerate. However, there are still more than 18 million vacant homes — down from the peak of more than 19 million, but still well above the pre-Great Recession level of 14 – 15 million. This indicator continues to suggest that the housing recovery is still in its early stages. The U.S. Census Bureau collects the data on household formation and housing vacancies.

On balance, the sharp rise in mortgage rates that commenced in mid- May 2013 will likely slow the pace of housing activity that had accelerated noticeably between mid-2011 and mid-2013. Despite the rise in rates, most of the indicators we watch suggest that the housing recovery remains firmly entrenched. The pace (and sustainability) of the housing recovery will help to determine the pace of the overall economic recovery. We expect housing — as measured by the residential investment component of GDP — to make a positive contribution to overall GDP growth in 2014, as it did in both 2012 and 2013. However, it will likely take several more years before the national housing market is back to normal.

______________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

______________________________________________________________________________________________________________________________

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC

Measuring Economic Expansion

August 13, 2013

The U.S. economy is now in the fifth year of the 12th economic recovery (or expansion) since the end of World War II. It is already the sixth-longest expansion and would have to last another year to become the fifth longest, as discussed in last week’s Weekly Economic Commentary: Revisiting the Recovery. This week, we will compare the performance of gross domestic product (GDP) — the broadest measure of economic activity — and its components (consumer spending, business capital spending, government spending, etc.) in the current recovery to previous economic recoveries.

Where We Stand vs. Prior Recoveries

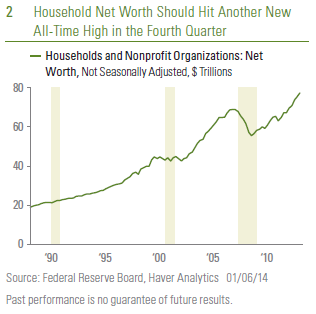

The Great Recession of 2007 – 2009 ended in the second quarter of 2009, and the economy has been growing for 16 quarters now. Of the other 11 economic expansions since the end of WWII, just five lasted at least four years — the recoveries that began in 1961, 1975, 1982, 1991, and 2001. By the end of their fourth year in the five expansions that lasted 16 quarters or more (or “comparable recoveries”), real GDP, on average, had increased by a cumulative 19% from the end of (or trough) the prior recession. In the current expansion, the economy has grown by just 9% over the last four years (from $14.4 trillion in Q209 to $15.6 trillion in Q213) [Figure 1].

The Pace of GDP

Consumer spending, which accounts for more than two-thirds of GDP, has matched the performance of overall GDP in this expansion, growing 9% from the trough versus an average 18% gain from the trough in the other five post WWII comparable recoveries. With the exception of exports, all the other major components of GDP — business capital spending, housing, business spending on structures (office parks, malls, factories, etc.), exports and government spending — have badly underperformed the average post-WWII recovery. Why has the current recovery been so lackluster even after such a severe recession?

Several factors along with uncertainty over legislative and regulatory policy in Washington have contributed to weak growth, not only in consumption, but in all the sectors of the economy over the past four years. These factors include strained balance sheets, only modest gains in the labor market, banks’ unwillingness to lend after billions of losses in the housing bust, and a weak external environment (recession in Europe, slowdown in China, and emerging markets).

While the current expansion has lagged comparable expansions in almost every category of GDP, it may not be an “apples-to-apples” comparison. As we noted in last week’s Weekly Economic Commentary, the U.S. economy has changed significantly since the end of the inflationary 1970s. The last 30-plus years has seen the transformation of the U.S. economy from a domestically focused manufacturing economy to a more export- heavy, service-based economy. In general, this economic structure is less prone to inventory swings that drove the shorter boom-bust cycles of the past, and has led to longer expansions. On average, the last three expansions — the ones that began in 1982, 1991, and 2001 — lasted 95 months, or roughly eight years. Using those three expansions as the standard, at 49 months (16 quarters) the current economic expansion is at its midpoint, but it has been far less robust.

Using just the last three economic expansions for comparison, the pace of GDP growth in the past four years still lags the average. GDP grew by 16% over the first four years of the last three expansions, and even by that standard the current recovery (9%) is not up to par. Still, in every major category — except exports, where the current recovery matches the prior three — the current expansion falls short, in some cases far short, of the past three recoveries, especially in government spending, housing, and business investment in structures. Taking the Pulse of Government Spending Government spending in all post-WWII expansions has generally not kept pace with overall growth in GDP. Four years into the average post-WWII expansion, government spending (federal, state, and local) has increased, by 10%, about half of the increase in overall GDP (20%) [Figure2]. In the past 30 years, government spending in the first four years of expansion has increased, on average, by just 9%, lagging the overall pace of economic activity but still adding to growth. However, in the current expansion, government spending has decreased by 6%, with state and local government spending taking the biggest hit (down 8% from the second quarter of 2009). At the federal level, overall spending is down 5% from the second quarter of 2009, with an 8% cut to defense spending more than offsetting a 4% increase in non-defense spending.

Spending at the state and local level is now stabilizing, after more than five years of spending cuts. At the federal level, the impact of the sequester, the fiscal cliff, and defense cuts were still reverberating through the economy as the second half of 2013 began. On balance, government spending should be less of a drag on growth in the next four years than it was in the first four of the recovery, when government spending added to growth in only three of 16 quarters.

Taking the Pulse of the Housing Market

Although it got a late start, housing — at the epicenter of the Great Recession — has outperformed the overall economy over the past four years (as it typically does during expansions), but underperformed relative to its performance in past expansions. Housing (as measured by investment in new residential structures) has increased by 30% over the past four years, far above the 9% gain in GDP in that span. But the 30% gain pales in comparison to the 50% average gain in housing in the first four years of all post-WWII recoveries, and also falls far short of the 51% average gain in housing during the past three expansions (1982, 1991, and 2001). The hangover from the housing bust (large amounts of unsold inventory, difficulty in obtaining financing, poor consumer credit profiles, and a lackluster labor market) helps explain housing’s underwhelming performance in this recovery.

Looking ahead, our view remains that housing is in the early stages of a long recovery, aided by pent-up demand, near record-low inventories, near record-high housing affordability, a steadily improving labor market, and banks’ increased willingness to lend to borrowers. The recent rise in mortgage rates is a concern, but will likely only slow, not stop, the ongoing recovery in housing, which is being driven, in part, by cash buyers and pent-up demand.

Taking the Pulse of Business Investment in New Structures

On average, business investment in new structures (shopping malls, office buildings and office parks, factories, etc.) over the first four years of all post-WWII expansions rose 6%, lagging the pace of the average recovery in GDP (19%) [Figure 2]. Why does business investment in structures lag overall growth? In part, because these are typically very large projects with long lead times and require outsized commitments of capital, so businesses want to make sure the expansion is well entrenched before committing resources. As a result, this segment of GDP tends to lag during the early part of expansions and then picks up steam as the expansion matures. We would expect the same pattern to repeat in the current expansion.

In the three expansions since 1980, business investment on structures actually dropped by 7% over the first 16 quarters of the expansion, lagging the average of all post-WWII expansions (a 6% gain over four years). But the current expansion has seen business investment in structures fall by 9% over the past four years, an even worse performance than in the past three expansions (a 7% decrease). Business uncertainty around the health and longevity of the expansion, the turmoil in Europe and slowdown in China, as well as the legislative and regulatory backdrop, overwhelmed the positive impact of lower financing rates and years of pent-up demand. We expect business investment in structures to pick up steam and become a bigger contributor to growth in the second half of the expansion, aided by somewhat less legislative and regulatory concern and more confidence in the economy.

Taking the Pulse of Business Investment in New Structures

On average, business investment in new structures (shopping malls, office buildings and office parks, factories, etc.) over the first four years of all post-WWII expansions rose 6%, lagging the pace of the average recovery in GDP (19%) [Figure 2]. Why does business investment in structures lag overall growth? In part, because these are typically very large projects with long lead times and require outsized commitments of capital, so businesses want to make sure the expansion is well entrenched before committing resources. As a result, this segment of GDP tends to lag during the early part of expansions and then picks up steam as the expansion matures. We would expect the same pattern to repeat in the current expansion.

In the three expansions since 1980, business investment on structures actually dropped by 7% over the first 16 quarters of the expansion, lagging the average of all post-WWII expansions (a 6% gain over four years). But the current expansion has seen business investment in structures fall by 9% over the past four years, an even worse performance than in the past three expansions (a 7% decrease). Business uncertainty around the health and longevity of the expansion, the turmoil in Europe and slowdown in China, as well as the legislative and regulatory backdrop, overwhelmed the positive impact of lower financing rates and years of pent-up demand. We expect business investment in structures to pick up steam and become a bigger contributor to growth in the second half of the expansion, aided by somewhat less legislative and regulatory concern and more confidence in the economy.

Expansion Lagging Average Post-WWII Recovery

Although it is four years old, the current economic expansion has not felt like a real expansion to many consumers and businesses. Indeed, the data suggest that in virtually every segment of the economy, the current expansion has lagged the average post-WWII expansion and the three expansions since 1980, which are more comparable. While some of the factors that have weighed on the expansion are lifting, others, notably rising interest rates, are poised to take their place and we continue to expect modest (near 2.0%) growth in 2013.

______________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System, is charged under the United States law with overseeing the nation’s open market operations (i.e., the Fed’s buying and selling of United States Treasure securities).

Quantitative easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC

Posted in GDP - Gross Domestic Product, Great Recession, Homebuilders, Housing, Recovery, Weekly Economic Commentary, WWII | Tagged: GDP, Great Recession, Homebuilders, Housing, Recovery, WWII | Leave a Comment »