What Is the Schedule of Events for the Fed This Week?

The Federal Reserve (Fed) holds its fourth (of eight this year) Federal Open Market Committee (FOMC) meeting this Tuesday and Wednesday, June 18 – 19. The meeting will be followed by an FOMC statement, and the FOMC’s latest economic and Fed funds projections at 2 PM ET. Fed Chairman Ben Bernanke’s second (of four) press conference of 2013 begins at 2:30 PM ET.

Will the Fed Raise Rates at This Meeting?

Since mid-May 2013, the market has moved up the date of the first Fed rate hike from late 2015/early 2016 to early 2015. In our view, the Fed is likely to keep rates lower for longer than the market now anticipates. This should help keep a lid on longer-term interest rates, such as the 10-year Treasury, and on instruments like mortgage rates, which are closely tied to the yield on Treasuries.

If the Fed Is Tapering Quantitative Easing (QE), Is It Tightening Monetary Policy?

No. As long as the Fed’s balance sheet is expanding, the Fed is easing monetary policy. In late 2010, President of the New York Fed William Dudley suggested in a speech that: “…$500 billion of purchases would provide about as much stimulus as a reduction in the federal funds rate of between half a point and three quarters of a point (50 to 75 basis points). “So, at $85 billion a month, the Fed is doing the equivalent of cutting the Fed funds rate (which has been near zero since late 2008) by 10 basis points per month. Even if the FOMC were to decide to taper purchases to $40 – $45 billion per month, it would still be “cutting” the Fed funds rate by around 5 basis points per month.

Will the Fed Act to Calm Financial Markets, Especially the Bond Market?

Since Ben Bernanke’s testimony to the Joint Economic Committee(JEC) of Congress on May 22, 2013, volatility has moved higher in financial markets. Bernanke’s appearance at the JEC, and especially the question and answer portion of the testimony suggested to the market that the FOMC was preparing to begin scaling back its purchases of Treasuries and mortgage backed securities (MBS). Prior to the testimony, markets generally thought that the FOMC would purchase $85 billion per month of Treasuries and MBS through at least the end of 2013. Since the JEC testimony, markets have begun to question that timing and are now expecting the Fed to begin tapering its purchases in September 2013. In our view, the decision for the Fed to continue with the current pace of QE is data dependent. Based on our forecast for the labor market, inflation, and the economy, the Fed is likely to continue its bond purchases through at least September 2013. At that time, the Fed may “test” run a temporary tapering with markets….

When Will the Fed Stop QE?

Even if the Fed does signal that it is prepared to begin tapering its purchases of Treasuries and MBS, it will, in our view, likely continue to pursue QE for some time, and perhaps until the end of 2014. While the Fed has provided “thresholds” for when it would consider raising its Fed funds rate: “… (low rates) will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.” it has stopped short of providing specific thresholds for ending QE. Instead, the Fed has said: “The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability.”

Can Congress Make the Fed Stop Quantitative Easing?

Yes. Congress, can, at any time, vote to take away or restrict the Fed’s dual mandate to: “…maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.” There are many voices in Congress — especially in the House — that are unhappy with the Fed’s pursuit of QE, and legislation has been introduced in both houses of Congress over the past several years that would limit the Fed’s mandate. It is highly unlikely that such legislation would pass the Senate in the current session of Congress.

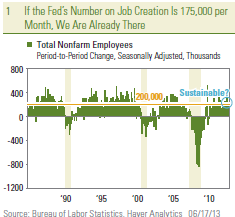

What Is the Fed’s Number on the Labor Market?

The QE debate among market participants — and likely among Fed policymakers as well — centers around the labor market and whether or not it has seen “real and sustainable” improvement. Over the past year, the U.S. economy has consistently created around 175,000 net new jobs per month. Some Fed policymakers have hinted that 150,000 jobs per month is the best the economy can do, and any job growth stronger than that could trigger inflation. Other Fed policymakers have suggested that 200,000 jobs per month is the right number to target, and that the Fed still has some work to do to get there. For some, 175,000 net new jobs per month could be the right number. Markets have their own view of what the “right number” is too. However, market participants looking for the FOMC to provide a specific target on job creation may be disappointed this week.

How Has the Labor Market Performed Since the Last FOMC Meeting in May 2013?

The FOMC has seen two jobs reports since the last FOMC meeting on May 1, 2013. The May 1, 2013 FOMC meeting was held a few days before the release of the April 2013 employment report. The May 2013 employment report was released on June 7, 2013. The April 2013 employment report showed that the economy created 165,000 jobs in April — far more than the 140,000 expected. The May 2013 employment report revealed that the economy added 175,000 jobs in May, in line with expectations and that the job counts over the prior two months were revised downward by a total of 12,000. The unemployment rate was 7.5% in April 2013 and 7.6% in May 2013. Several other labor market metrics the Fed is known to be watching (see our Weekly Economic Commentary: Watch What the Fed Watches, March 25, 2013, for more details)have been mixed at best since the last FOMC meeting. In our view, the labor market is improving, but the recent pace of job creation (around 175,000 per month) seems likely to persist until the economy can grow more robustly than 2.0% to 2.5%.

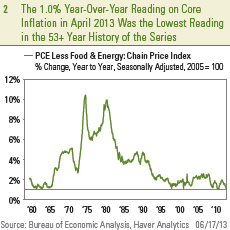

Isn’t the FOMC Worried About Inflation Anymore?

As has been the case since Congress amended the Federal Reserve Act to grant the Fed’s dual mandate (see above), the FOMC’s job has been to promote full employment and stable prices. In recent years, the FOMC has been much more concerned with deflation — a prolonged period of falling wages and prices — than it has been about inflation. Recent readings on the Fed’s preferred measure of inflation, the personal consumption deflator excluding food and energy (core PCE deflator), have been decelerating. In March 2012, the year-over-year reading on the Fed’s preferred measure of inflation was 2.0%. The latest reading (April 2013) shows that core inflation is now at 1.0%, which matches the lowest reading ever in the 53+ year history of the data series. In our view, there are still more factors pushing down on inflation than pushing up on inflation (see the Weekly Economic Commentary from March 18, 2013 for more details) and the Fed’s primary focus right now is on the other side of its dual mandate.

____________________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior t0 investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Mortgage-Backed Securities are subject to credit, default risk, prepayment risk that acts much like call risk when you get your principal back sooner than the stated maturity, extension risk, the opposite of prepayment risk, and interest rate risk.

Stock investing involves risk including loss of principal.

Federal Funds Rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis.

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System, is charged under the United States law with overseeing the nation’s open market operations (i.e., the Fed’s buying and selling of United States Treasure securities).

Quantitative easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

___________________________________________________________________________________________________________________________________

INDEX DESCRIPTIONS

The “core” PCE price index is defined as personal consumption expenditures (PCE) prices excluding food and energy prices. The core PCE price index measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends.

Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

________________________________________________________________________________________________________________________________

This research material has been prepared by LPL Financial. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC