Navigating the Markets

Compass Changes

- Upgraded health care to neutral from negative/neutral

- Upgraded emerging market debt to neutral/positive from neutral

- Upgraded oil commodity from neutral/negative to neutral

- Downgraded precious metals commodities from neutral/positive to neutral

- Downgraded technology from neutral/positive to neutral

Investment Takeaways

- Our near-term stock market view is slightly cautious, given our Base Path expectation for modest single-digit returns in 2013.*

- We continue to favor cyclical sectors over defensives over the balance of the year, but our near-term views are balanced.

- Higher-yielding, fundamentally sound segments of the bond market remain attractive, but low yields and valuations temper our enthusiasm.

- We upgraded our emerging market debt view following under performance during the first quarter.

- We see the oil commodity as near fair value following the latest correction, while deteriorating technicals drive our lowered precious metals view.

- From a technical perspective, the S&P 500 may turn lower over the next few weeks; next support is at 1540, followed by 1500.

Broad Asset Class Views

LPL Financial Research’s views on stocks, bonds, cash, and alternatives are illustrated below. The positions of negative, neutral, or positive are indicated by the solid black compass needle, while an outlined needle shows a previous view.

Equity & Alternative Asset Classes

Maintain Slightly Cautious Stock Market View as S&P 500 Remains Near All-Time Highs

Our near-term stock market view is slightly cautious, given our Base Path expectation for modest single-digit returns in 2013.*

Our views are generally aligned across market cap, with a slight preference for large and mid caps. In our Base Path scenario in Outlook 2013, we expect the market to favor the stability, lower valuations, and higher yields associated with large caps.

We maintain a modest preference for growth over value due to growth’s potential to perform well in slow-growth environments, although our conviction has lessened as our sector views have become more balanced.

Our neutral emerging markets (EM) view reflects higher near-term risks as China implements measures to curb its property markets and has produced uneven growth.

Our large foreign view is neutral. Although bold policy actions and valuations are supportive, and the outlook in Japan has improved, Europe remains mired in recession and the Eurozone debt crisis is not yet over.

Fed policy remains supportive of precious metals, but US dollar gains, little inflation pressure, and the rotation into equities have driven a technical breakdown in the gold commodity price.

Now that the oil commodity has pulled back into the high $80s, we believe it is near fair value.

All performance referenced herein is as of April 16, 2013, unless otherwise noted. * LPL Financial Research provided these forecasts based on: a low-single-digit earnings growth rate supported by modest share buybacks combined with 2% dividend yields and little change in valuations for the S&P 500. Please see our Outlook 2013 for details.

Real Estate/REITs may result in potential illiquidity and there is no assurance the objectives of the program will be attained. The fast price swings of commodities will result in significant volatility in an investor’s holdings. International and emerging markets involve special risks such as currency fluctuation and political instability. The price of small and mid-cap stocks are generally more volatile than large capstocks. Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time. Precious metal investing is subject to substantial fluctuation and potential for loss. These securities may not be suitable for all investors. Alternative strategies may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses. Stock investing may involve risk including loss of principal.

Equity Sectors

More Balanced Sector Mix After Health Care Upgrade to Neutral

We continue to favor cyclical sectors over defensives over the balance of the year, but our near-term views are balanced as we anticipate a modest pullback in the S&P 500.

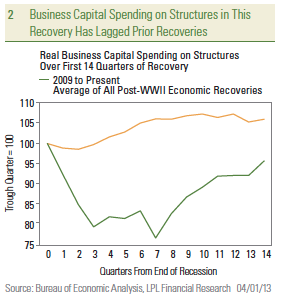

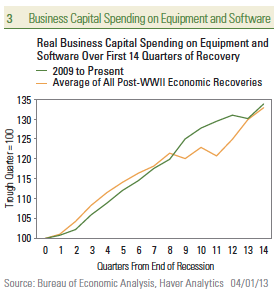

While we continue to expect a pickup in business spending, our lowered technology view reflects a weaker earnings outlook and deteriorating technicals. Industrials is our favored way to play a potential pickup in business spending.

Our recent decision to lower our materials view reflected the risk to China’s growth and strength in the US dollar amid concerns that the Federal Reserve (Fed) will soon pare back stimulus.

Our energy view remains neutral due to our expectation that elevated inventories will prevent a rebound in crude oil prices from current levels in the high $80s.

Our upgraded, neutral health care view reflects our desire to balance out the economic sensitivity of our sector mix, policy clarity, and a strong technical picture.

Our utilities view is modestly negative due to interest rate risk and rich valuations, although our outlook is less negative amid improved technicals.

Our consumer staples view is neutral despite rich valuations due to the potential to benefit from lower commodity prices and the potential for a pullback.

Our financials view is modestly negative. Bank fundamentals have improved some, but the challenging regulatory and interest rate environment persists and loan growth is stalling.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Fixed Income

Focus on Higher-Yielding Segments Due to Better Valuation and as Buffer Against Rise in Rates

- A range-bound environment persists in the bond market. Lingering uncertainties augur for a stable rate environment, which favors intermediate bonds that still possess a substantial yield advantage relative to short-term bonds.

- By committing to refrain from raising interest rates until unemployment falls to 6.5%, intermediate maturity bonds may also benefit from Fed policy as investors seek higher yields amid a low-yield world.

- We continue to find municipal bonds among the more attractive high-quality bond options, and valuations remain attractive following a difficult March.

Focus on Higher-Yielding Segments Due to Better Valuation and as Buffer Against Rise in Rates

- We upgrade emerging market debt following underperformance during the first quarter relative to other higher-yielding segments of the bond market, thereby providing an opportunity for investors.

- Higher-yielding, fundamentally sound segments of the bond market such as high-yield bonds, bank loans, and preferred securities remain attractive, but we temper our enthusiasm due to a strong start to 2013. Lower yields and higher valuations augur for lower returns going forward.

- Bank loans remain attractive due to a much narrower yield differential to high-yield bonds.

All bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availably and change in price. High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors. Mortgage-backed securities are subject to credit, default risk, prepayment risk that acts much like call risk when you get your principal back sooner than the stated maturity, extension risk, the opposite of prepayment risk, and interest rate risk. International and emerging market investing involves risks such as currency fluctuation and political instability and may not be suitable for all investors. Bank loans are loans issued by below investment-grade companies for short term funding purposes with higher yield than short-term debt and involve risk. Treasury inflation-protected securities (TIPS) help eliminate inflation risk to your portfolio as the principal is adjusted semiannually for inflation based on the Consumer Price Index – while providing a real rate of return guaranteed by the U.S. government. Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity and redemption features. Foreign Bonds – Hedged: Non-U.S. fixed income securities generally from investment-grade issuers in developed countries, with hedged currency exposure. Foreign Bonds – Unhedged: Non-U.S. fixed income securities normally denominated in major foreign currencies.

DEFINITIONS:

EQUITY AND ALTERNATIVES ASSET CLASSES

Large Growth: Stocks in the top 70% of the capitalization of the U.S. equity market are defined as Large Cap. Growth is defined based on fast growth (high growth rates for earnings,

sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Large Value: Stocks in the top 70% of the capitalization of the U.S. equity market are defined as Large Cap. Value is defined based on low valuations (low price ratios and high dividend

yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

Mid Growth: The U.S. mid-cap range for market capitalization typically falls between $1 billion and $8 billion and represents 20% of the total capitalization of the U.S. equity market.

Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Mid Value: The U.S. Mid Cap range for market capitalization typically falls between $1 billion and $8 billion and represents 20% of the total capitalization of the U.S. equity market. Value

is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

Small Growth: Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as Small Cap. Growth is defined based on fast growth (high growth rates for earnings,

sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Small Value: Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as Small Cap. Value is defined based on low valuations (low price ratios and high

dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

U.S. Stocks: Stock of companies domiciled in the U.S.

Large Foreign: Large-cap foreign stocks have market capitalizations greater than $5 billion. The majority of the holdings in the large foreign category are in the MSCI EAFE Index.

Small Foreign: Small-cap foreign stocks typically have market capitalizations of $250M to $1B. The majority of the holdings in the small foreign category are in the MSCI Small Cap EAFE Index.

Emerging Markets: Stocks of a single developing country or a grouping of developing countries. For the most part, these countries are in Eastern Europe, Africa, the Middle East, Latin

America, the Far East and Asia.

REITs: REITs are companies that develop and manage real-estate properties. There are several different types of REITs, including apartment, factory-outlet, health-care, hotel, industrial, mortgage, office, and shopping center REITs. This would also include real-estate operating companies.

Commodities – Industrial Metals: Stocks in companies that mine base metals such as copper, aluminum and iron ore. Also included are the actual metals themselves. Industrial metals

companies are typically based in North America, Australia, or South Africa.

Commodities – Precious Metals: Stocks of companies that do gold- silver-, platinum-, and base-metal-mining. Precious-metals companies are typically based in North America, Australia, or South Africa.

Commodities – Energy: Stocks of companies that focus on integrated energy, oil & gas services, oil & gas exploration and equipment. Public energy companies are typically based in North America, Europe, the UK, and Latin America.

Merger Arbitrage is a hedge fund strategy in which the stocks of two merging companies are simultaneously bought and sold to create a riskless profit. A merger arbitrageur looks at

the risk that the merger deal will not close on time, or at all. Because of this slight uncertainty, the target company’s stock will typically sell at a discount to the price that the combined

company will have when the merger is closed. This discrepancy is the arbitrageur’s profit.

Long/Short is an investment strategy generally associated with hedge funds. It involves buying long equities that are expected to increase in value and selling short equities that are

expected to decrease in value.

EQUITY SECTORS

Materials: Companies that engage in a wide range of commodity-related manufacturing. Included in this sector are companies that manufacture chemicals, construction materials, glass,

paper, forest products and related packaging products, metals, minerals and mining companies, including producers of steel.

Energy: Companies whose businesses are dominated by either of the following activities: The construction or provision of oil rigs, drilling equipment and other energy-related service and equipment, including seismic data collection or the exploration, production, marketing, refining and/or transportation of oil and gas products, coal and consumable fuels.

Industrials: Companies whose businesses: Manufacture and distribute capital goods, including aerospace and defense, construction, engineering and building products, electrical

equipment and industrial machinery; provide commercial services and supplies, including printing, employment, environmental and office services; provide transportation services,

including airlines, couriers, marine, road and rail, and transportation infrastructure.

Consumer Discretionary: Companies that tend to be the most sensitive to economic cycles. Its manufacturing segment includes automotive, household durable goods, textiles and apparel, and leisure equipment. The service segment includes hotels, restaurants and other leisure facilities, media production and services, consumer retailing and services and education services.

Technology: Companies that primarily develop software in various fields such as the Internet, applications, systems and/or database management and companies that provide information technology consulting and services. Technology hardware & equipment include manufacturers and distributors of communications equipment, computers and peripherals, electronic equipment and related instruments, and semiconductor equipment and products.

Financials: Companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, insurance and investment, and real estate, including REITs.

Utilities: Companies considered electric, gas or water utilities, or companies that operate as independent producers and/or distributors of power.

Health Care: Companies in two main industry groups: Healthcare equipment and supplies or companies that provide healthcare-related services, including distributors of healthcare

products, providers of basic healthcare services, and owners and operators of healthcare facilities and organizations or companies primarily involved in the research, development,

production and marketing of pharmaceuticals and biotechnology products.

Consumer Staples: Companies whose businesses are less sensitive to economic cycles. It includes manufacturers and distributors of food, beverages and tobacco, and producers of non-durable household goods and personal products. It also includes food and drug retailing companies.

Telecommunications: Companies that provide communications services primarily through a fixed line, cellular, wireless, high bandwidth and/or fiber-optic cable network.

FIXED INCOME

Credit Quality: An individual bond’s credit rating is determined by private independent rating agencies such as Standard & Poor’s, Moody’s and Fitch. Their credit quality designations

range from high (‘AAA’ to ‘AA’) to medium (‘A’ to ‘BBB’) to low (‘BB’, ‘B’, ‘CCC’, ‘CC’ to ‘C’).

Duration: A measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Rising

interest rates mean falling bond prices, while declining interest rates mean rising bond prices. The bigger the duration number, the greater the interest-rate risk or reward for bond prices.

Munis – Short-term: Bonds issued by various state and local governments to fund public projects. The income from these bonds is generally free from federal taxes. These bonds generally have maturities of less than three years.

Munis – Intermediate: Bonds issued by various state and local governments to fund public projects. The income from these bonds is generally free from federal taxes. These bonds

generally have maturities of between 3 and 10 years.

Munis – Long-term: Bonds issued by various state and local governments to fund public projects. The income from these bonds is generally free from federal taxes. These bonds generally

have maturities of more than 10 years.

Munis – High-yield: Bonds issued by various state and local governments to fund public projects. The income from these bonds is generally free from federal taxes. These bonds generally

offer higher yields than other types of bonds, but they are also more vulnerable to economic and credit risk. These bonds are rated BB+ and below.

Treasuries: A marketable, fixed-interest U.S. government debt security. Treasury bonds make interest payments semi-annually and the income that holders receive is only taxed at the federal level.

TIPS (Treasury Inflation Protected Securities): A special type of Treasury note or bond that offers protection from inflation. Like other Treasuries, an inflation-indexed security pays interest every six months and pays the principal when the security matures. The difference is that the underlying principal is automatically adjusted for inflation as measured by the consumer price index (CPI).

Mortgage-Backed Securities: A type of asset-backed security that is secured by a mortgage or collection of mortgages. These securities must also be grouped in one of the top two ratings as determined by a accredited credit rating agency, and usually pay periodic payments that are similar to coupon payments. Furthermore, the mortgage must have originated from a regulated and authorized financial institution.

Investment-Grade Corporates: Securities issued by corporations with a credit ratning of BBB- or higher. Bond rating firms, such as Standard & Poor’s, use different designations consisting of upper- and lower-case letters ‘A’ and ‘B’ to identify a bond’s investment-grade credit quality rating. ‘AAA’ and ‘AA’ (high credit quality) and ‘A’ and ‘BBB’ (medium credit quality) are considered investment-grade.

Preferred Stocks: A class of ownership in a corporation that has a higher claim on the assets and earnings than common stock. Preferred stock generally has a dividend that must be paid

out before dividends to common stockholders and the shares usually do not have voting rights.

High-Yield Corporates: Securities issued by corporations with a credit rating of BB+ and below. These bonds generally offer higher yields than investment-grade bonds, but they are also

more vulnerable to economic and credit risk.

Bank Loans: In exchange for their credit risk, these floating-rate bank loans offer interest payments that typically float above a common short-term benchmark such as the London

interbank offered rate, or LIBOR.

Foreign Bonds – Hedged: Non-U.S. fixed income securities generally from investment-grade issuers in developed countries, with hedged currency exposure.

Foreign Bonds – Unhedged: Non-U.S. fixed income securities normally denominated in major foreign currencies.

Emerging Market Debt: The debt of sovereigns, agencies, local issues, and corporations of emerging markets countries and subject to currency risk.

______________________________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

Past performance is no guarantee of future results.

For the purposes of this publication, intermediate-term bonds have maturities between 3 and

Stock investing involves risk including loss of principal.

Preferred stock investing involves risk, which may include loss of principal.

Distressed investing involves significant risks, including a total loss of capital. The risks associated with distressed investing arise from several factors including: limited diversification,

the use of leverage, limited liquidity, and the possibility that investors may be required to accept cash or securities with a value less than their original investment and/or may be required to accept payment over an extended period of time.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate

market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not

an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit