Last week (May 13 – 17), markets digested reports on gross domestic product (GDP) growth in the Eurozone during the first quarter of 2013 (please see “The Big Picture” for details about the Eurozone’s structure). Overall real GDP in the Eurozone contracted by 0.2% in the first quarter of 2013, following the 0.6% drop in the fourth quarter of 2012. The Eurozone’s economic contraction in the first quarter of 2013 was its sixth consecutive quarter of decline, dating back to the fourth quarter of 2011. Among the larger economies in Europe, only Germany (+0.1%) and Belgium (+0.1%) saw first quarter 2013 gains in their economies, while Austria’s GDP was unchanged between the fourth quarter of 2012 and the first quarter of 2013. France (-0.2%), Italy (-0.5%), Spain (-0.5%), and the Netherlands (-0.1%) all saw their economies contract in the first quarter of 2013.

Among the smaller economies on the Eurozone’s periphery, the news was just as bad, but the string of weak GDP readings extends back much further. Real GDP in Greece declined 0.6% in the first quarter of 2013, marking the 13th consecutive quarter of contraction. Greece’s economy has now contracted in 20 of the past 23 quarters since mid-2007. Over that time, the Greek economy has shrunk by 23%. Real GDP in Portugal contracted by 0.3% in the first quarter of 2013, marking the 10th consecutive quarterly decline. Ireland’s GDP fell just 0.1% in the first quarter of 2013, and it has managed just three quarters of growth since late 2010.

Looking ahead, financial markets seem to suggest that the double-dip recession in Europe — recession in 2008 and 2009, a modest, halting recovery in 2010 and early 2011, followed by another recession since mid-2011 — may be ending, and that the Eurozone economy may eke out small gains in the second half of 2013. The consensus of economists (as compiled by Bloomberg News) sees real GDP in the Eurozone contracting in both the second and third quarters of 2013, before a modest upswing begins in late 2013. Our view remains that the Eurozone is likely to be in a recession throughout 2013, despite the best efforts of the ECB and other policymakers.

The Fix? Some Keys to Help Strengthen Eurozone Economic Growth

As we have noted in prior publications, there are several keys to help strengthen economic growth in the Eurozone, including, but not limited to:

- Fixing Europe’s broken financial transmission mechanism;

- Broad-based labor market reforms;

- European-wide banking reform (including a pan-European deposit insurance scheme); and

- Financial sector reforms.

In our view, fixing Europe’s broken financial transmission mechanism should be at the top of European policymakers’ long list of “to dos.” The ECB, like almost every other major central bank around the globe, has lowered the rate at which banks can borrow from the ECB, expanded the ECB’s balance sheet to purchase securities in the open market (QE), and tried to encourage banks and other financial institutions to lend, and businesses and consumers in Europe to borrow. The results, however, have not (as yet) had the intended effect: to get badly needed credit (in the form of loans) into the European economy, and especially to the consumer and small businesses. In short, the mechanism that allows credit to flow from the ECB, to banks and financial institutions, and finally to businesses and consumers was badly damaged in the Great Recession and its aftermath.

Major European-based global corporations are benefitting from the ECB’s actions, and are taking advantage of low borrowing costs and relatively healthy — although not quite back to normal — European capital markets to issue debt and fund operations. While credit via traditional credit markets is flowing to large, global corporations in Europe, credit to SMEs, is severely restricted dampening economic activity.

How European Banks Can Help

As in the United States, most SMEs in Europe cannot borrow in the capital markets, so they rely on bank loans, and other types of bank-based funding for working capital and cash to expand existing business. This is especially true in countries at the periphery of Europe, like Greece, Portugal, Cyprus, and increasingly in core European nations like Spain and Italy. The problem is that the main conduits of the ECB’s low rates and QE policies are European banks, which:

- Are undercapitalized;

- Are reluctant to lend;

- Are losing deposits;

- Lack regulatory clarity; and

- Have impaired balance sheets.

Therefore, European banks are not lending, or more precisely, not lending enough.

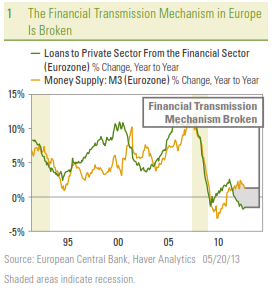

Figure 1 shows the breakdown in the financial transmission mechanism in Europe. Money supply growth (a decent proxy for the ECB’s actions to pump liquidity into the system) is running at around 2 – 3% year over year. Not robust growth, but enough to foster some lending by financial institutions. The other line on Figure 1 shows that despite the 2 – 3% growth in money supply in Europe, loans by financial institutions in Europe to private sector borrowers (SMEs and consumers) have turned negative. Therefore, credit to two key components of the Eurozone economy is contracting. The gap between these two lines is a good proxy for the broken financial transmission mechanism in Europe.

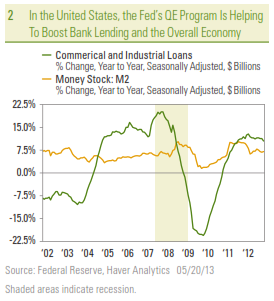

A quick look at Figure 2, which shows similar U.S. metrics (M2: money supply and bank lending), reveals that the financial transmission mechanism — while not quite back to normal — is functioning a lot better than Europe’s. M2 growth is running at around 7% year over year, while bank lending to businesses is running close to 10% year over year.

How the ECB and Policymakers Can Help

What would help to repair Europe’s broken transmission mechanism, and in turn, help to boost economic growth in the Eurozone? One way would be if the ECB was willing to take some credit risk on their balance sheet, and take an approach similar to the Bank of England’s (BOE) “credit easing” program. The BOE announced in late 2011 and mid-2012 that it would provide cheap loans and loan guarantees to the banking system to encourage the banks to lend more. Or, the ECB could decide to make loans directly to SMEs, essentially bypassing the broken European financial mechanism. Such a move by the ECB, of course, remains difficult — although not impossible — to achieve, given the fractured state of banking regulation in Europe and reluctance by key constituencies within the Eurozone to expand the ECB’s mandate. The bottom line is that until the ECB (or other policymakers) can agree on a plan to get more credit to capital-starved SMEs and consumers in Europe, we don’t think a meaningful recovery in Europe’s economy is in the cards.

________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk including loss of principal.

Quantitative easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

________________________________________________________________________________________________________________________

INDEX DESCRIPTIONS

Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

________________________________________________________________________________________________________________________

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is

not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit