Stocks Limped to the Finish but Delivered Solid Double-Digit Returns in 2012

The U.S. economy faces the weakest global backdrop since the Great Recession of 2008 – 09, as the drag from the so-called fiscal cliff — the combination of tax increases and spending cuts — looms in 2013. Also contributing to subpar economic growth at the end of the year was the ongoing recession in Europe and the impact of Superstorm Sandy in the northeastern United States. The benefits of Federal Reserve (Fed) stimulus and the positive consumer wealth effect of the rebounding housing and stock markets provided a partial offset, but the economy remained on a path of weak economic growth as 2013 approached.

Stocks limped to the finish as 2012 ended but delivered solid double-digit returns in 2012, consistent with our forecast as laid out in our Outlook 2012 publication. Several challenges prevented the S&P 500 in the fourth quarter from building on the strong gains in the first nine months of the year, most notably the fiscal cliff. In late October, the massive disruption from Superstorm Sandy put downward pressure on the economy, followed by a post-election slide in early November ahead of the contentious lame duck session in Congress that increased stock market volatility in December.

The Barclays Aggregate Bond Index eked out a marginal 0.2% return in the fourth quarter, which brought the total return for the broad bond market index in 2012 to 4.2%, consistent with our forecast for low to mid-single-digit total returns initially noted in our Outlook 2012. The quarter and the year were led by more economically sensitive and higher yielding bond sectors, such as high-yield and investment-grade corporate bonds and emerging market debt.

Commodities were unable to build on solid third quarter gains, as the Dow Jones-UBS Commodity Index fell 6.4% during the fourth quarter. The commodity index followed the equity market for the majority of the quarter, before diverging starting in late November, as stocks grinded higher in anticipation of a budget compromise in Washington while commodities fell. For the year, commodities were essentially flat as lower crude oil prices offset gains in natural gas, metals, and agriculture.

Economy – Fiscal Cliff Uncertainty, Superstorm Sandy Weigh on Economic Growth

The U.S. economy faces the weakest global backdrop since the Great Recession of 2008 – 09, as the drag from the so-called fiscal cliff — the combination of tax increases and spending cuts — looms in 2013. Also contributing to subpar economic growth at the end of the year was the ongoing recession in Europe and the impact of Superstorm Sandy in the northeastern United States. The benefits of Federal Reserve (Fed) stimulus and the positive consumer wealth effect of the rebounding housing and stock markets provided a partial offset, but the economy remained on a path of weak economic growth as 2013 approached.

Third quarter gross domestic product (GDP) did surprise on the upside, with the latest revision showing a 3.1% annualized growth rate after an initial reading of 2.0%, and up from 1.3% in the prior (second) quarter [Figure 1]. The upward revision was driven by government spending and higher inventories, neither of which are likely to be sustained. Government spending actually grew 3.9% in the quarter, the fastest in more than three years, ahead of looming spending cuts prescribed by the Budget Control Act of 2011. Consumer spending continued to hang in, growing 1.6% in the quarter, while housing construction was a bright spot. Trade was a positive contributor to growth, as imports fell marginally and exports rose modestly as the US dollar stabilized and Europe fears abated.

Lower business investment was a drag on growth in the third quarter. Budget uncertainty in Washington following the status quo election outcome in the White House and Congress led company management teams to sit on cash, or return it to shareholders in the form of dividends and share buybacks, rather than make longer term commitments by increasing capital expenditures. A decline in farm inventory related to the summer drought was also a drag on growth during the quarter.

Lower business investment was a drag on growth in the third quarter. Budget uncertainty in Washington following the status quo election outcome in the White House and Congress led company management teams to sit on cash, or return it to shareholders in the form of dividends and share buybacks, rather than make longer term commitments by increasing capital expenditures. A decline in farm inventory related to the summer drought was also a drag on growth during the quarter.

Core inflation moderated from 1.7% to 1.1%, providing a favorable backdrop for additional bond purchases from the Fed announced in December. Aggressive stimulus from the Fed in the form of additional quantitative easing (fresh purchases of Treasuries and mortgage-backed securities [MBS]) has kept mortgage and other borrowing costs low while supporting exports by limiting appreciation of the US dollar versus those of our key trading partners.

Data available for the fourth quarter suggest the sluggish growth experienced in the first half of 2012 — at or below a 2% pace — will continue. The Fed and the recovery in the housing markets remain supportive, but with higher taxes and spending cuts looming in 2013, even with greater budget certainty, any meaningful pickup in consumer or business spending beyond 2% to close out 2012 and as 2013 gets underway appears unlikely.

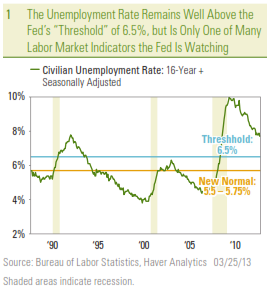

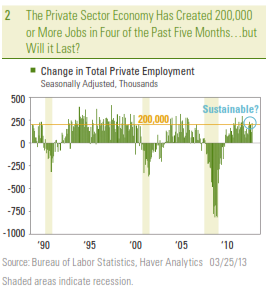

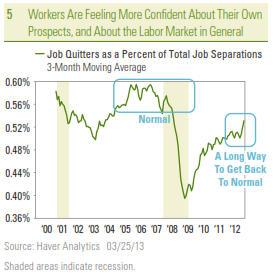

The sluggish pace of growth reflected in recent data is not sufficient to drive a meaningful pickup in the labor market. Job growth has improved marginally but remains lackluster while the unemployment rate remains stubbornly high. In addition to policy uncertainty, Superstorm Sandy has had a negative impact, although job losses from the storm should reverse in the coming months as the rebuilding effort gathers steam. The economy created an average of about 180,000 private sector jobs in September through December, still below the pace that would typically be seen at this stage of an economic recovery, but a bit better than the pace of the spring and summer months. (See our January 7, 2013 Weekly Economic Commentary: Full Speed Recovery? for a comparison of the current economic recovery versus previous recoveries.) The unemployment rate has been below 8.0% since September, but a shrinking labor force continues to drive the modest improvement (the dominator in the unemployment rate calculation). On the bright side, the December 2012 reading of 168,000 new private sector jobs represented a positive surprise.

The sluggish pace of growth reflected in recent data is not sufficient to drive a meaningful pickup in the labor market. Job growth has improved marginally but remains lackluster while the unemployment rate remains stubbornly high. In addition to policy uncertainty, Superstorm Sandy has had a negative impact, although job losses from the storm should reverse in the coming months as the rebuilding effort gathers steam. The economy created an average of about 180,000 private sector jobs in September through December, still below the pace that would typically be seen at this stage of an economic recovery, but a bit better than the pace of the spring and summer months. (See our January 7, 2013 Weekly Economic Commentary: Full Speed Recovery? for a comparison of the current economic recovery versus previous recoveries.) The unemployment rate has been below 8.0% since September, but a shrinking labor force continues to drive the modest improvement (the dominator in the unemployment rate calculation). On the bright side, the December 2012 reading of 168,000 new private sector jobs represented a positive surprise.

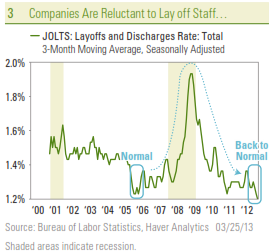

Despite sluggish job growth, marginal improvement (at best) in the stubbornly high unemployment rate, disruptions from Superstorm Sandy, and prospects for higher taxes in 2013, consumers hung in at the end of 2012 [Figure 2]. Total retail sales in November, as reported by the U.S. government, rose a respectable 3.7% year-over-year, as the wealth effect from higher stock and home prices and the start of Sandy rebuilding efforts helped offset the hit to consumer traffic in the early part of the month in the aftermath of the storm. Sales in the 2012 holiday shopping season were disappointing, only matching lowered expectations, not surprising given the impact of Sandy and the uncertainty surrounding the fiscal cliff negotiations. Looking forward, leading indicators continue to point toward growth, not recession [Figure 3].

Despite sluggish job growth, marginal improvement (at best) in the stubbornly high unemployment rate, disruptions from Superstorm Sandy, and prospects for higher taxes in 2013, consumers hung in at the end of 2012 [Figure 2]. Total retail sales in November, as reported by the U.S. government, rose a respectable 3.7% year-over-year, as the wealth effect from higher stock and home prices and the start of Sandy rebuilding efforts helped offset the hit to consumer traffic in the early part of the month in the aftermath of the storm. Sales in the 2012 holiday shopping season were disappointing, only matching lowered expectations, not surprising given the impact of Sandy and the uncertainty surrounding the fiscal cliff negotiations. Looking forward, leading indicators continue to point toward growth, not recession [Figure 3].

Stock Markets – Fiscal Cliff Uncertainty Prevents Stocks From Building on 2012 Gains

Stocks limped to the finish as 2012 ended, but delivered solid double-digit returns in 2012, consistent with our forecast as laid out in our Outlook 2012 publication. Several challenges prevented the S&P 500 in the fourth quarter from building on the strong gains in the first nine months of the year [Figure 4], most notably the fiscal cliff — the combination of tax increases and spending cuts scheduled to take effect after year-end. In late October, the massive disruption from Superstorm Sandy put downward pressure on the economy, followed by a post-election slide in early November, which based on the status quo outcome, set the stage for the contentious lame duck session in Congress that increased stock market volatility in December.

Besides complacency among market participants, the primary factor offsetting the downward pressure on the economy and markets late in 2012 was the Fed. After announcing a third round of quantitative easing (QE3) in September under which the Fed would purchase $40 billion in MBS each month, it followed that with an additional $45 billion of fresh Treasury purchases announced in mid-December, which confirmed the market’s expectation that the program would be maintained for the foreseeable future. These moves are expected to keep interest rates and borrowing costs low, and continue to push investors further out on the risk spectrum away from Treasuries and other high-quality fixed income investments, and cash. Meanwhile, looking outside the United States, relative stability in Europe and an improved growth outlook for China following its leadership transition also helped offset the drag from U.S. policy uncertainty and prevent stocks from suffering more than a modest fourth quarter decline.

Besides complacency among market participants, the primary factor offsetting the downward pressure on the economy and markets late in 2012 was the Fed. After announcing a third round of quantitative easing (QE3) in September under which the Fed would purchase $40 billion in MBS each month, it followed that with an additional $45 billion of fresh Treasury purchases announced in mid-December, which confirmed the market’s expectation that the program would be maintained for the foreseeable future. These moves are expected to keep interest rates and borrowing costs low, and continue to push investors further out on the risk spectrum away from Treasuries and other high-quality fixed income investments, and cash. Meanwhile, looking outside the United States, relative stability in Europe and an improved growth outlook for China following its leadership transition also helped offset the drag from U.S. policy uncertainty and prevent stocks from suffering more than a modest fourth quarter decline.

The fourth quarter started off on a down note with a 1.8% decline in October — the worst month since May — amid election uncertainty and the impact of Sandy. The selling pressure then accelerated after the election, pushing the S&P 500 to its low for the quarter on November 15, 2012, at 1353. Stocks then staged an impressive turnaround, rallying 7% over the next month to the high at 1447, supported by confidence that a deal to avert the fiscal cliff would be reached before year-end. After a modestly positive November in which the S&P 500 returned 0.6%, stocks edged slightly higher in December as the market expressed confidence that a budget deal in Washington would be reached.

Heightened fears that the U.S. economy would go over the fiscal cliff led to an increase in stock market volatility in late December. The VIX, a measure of expected stock market volatility, remained low relative to its historical averages — in the mid-to-high teens — throughout much of the quarter before jumping to over 20 in the last week of the year for the first time since July. Looking at volatility another way, after just two days in which the S&P 500 lost more than 1% in the third quarter, investors experienced six such days in the fourth quarter, including three in the week following the election on November 6, 2012.

Heightened fears that the U.S. economy would go over the fiscal cliff led to an increase in stock market volatility in late December. The VIX, a measure of expected stock market volatility, remained low relative to its historical averages — in the mid-to-high teens — throughout much of the quarter before jumping to over 20 in the last week of the year for the first time since July. Looking at volatility another way, after just two days in which the S&P 500 lost more than 1% in the third quarter, investors experienced six such days in the fourth quarter, including three in the week following the election on November 6, 2012.

More economically sensitive, or cyclical, sectors generally fared better than defensive sectors again in the fourth quarter after re-establishing leadership during the third [Figure 5]. Financials topped S&P sectors in the quarter with a 5.9% return amid stability in Europe, resilient earnings, attractive valuations, and the ongoing housing recovery. The industrials sector was also a solid performer, as prospects for growth in China improved and the market priced in less onerous spending cuts than those prescribed in the sequestration comprising a portion of the fiscal cliff. While the best-performing sectors were cyclical, technology was a disappointment, weighed down by the more than 20% decline in Apple shares. Despite the 5.7% loss in the quarter, the technology sector still finished the year with a 14.8% return, trailing the S&P 500 by just over 1%. Other sector losers in the quarter included telecom and utilities, which fell 6.0% and 2.9%, respectively, and were hurt by prospects for higher dividend tax rates in 2013.

A strong fourth quarter cemented financials’ place as the biggest sector winner in 2012. The sector was buoyed by stability in Europe, support from the Fed, and an improving housing market, which combined to drive a strong year for the stock and credit markets in 2012. Led by home improvement and internet retailers and media companies, the consumer discretionary sector outperformed for the fifth straight year with a stellar 23.8% return. Consumer spending continued to hang in there with help from higher stock and home prices, the so-called wealth effect, despite only modest gains in consumer incomes and employment. On the downside, it was a tough year for the utilities sector amid the challenging regulatory environment, lackluster growth, Superstorm Sandy disruptions, and prospects for higher dividend tax rates.

Like sector performance, market cap performance also revealed investors’ preference for a bit more cyclicality and market sensitivity in the fourth quarter. Mid cap stocks performed best in the quarter, as the Russell Midcap Index returned 2.9%, outpacing both the large cap Russell 1000 Index (+0.1%) and the small cap Russell 2000 Index (+1.9%). Mid caps also benefited from an increase in merger and acquisition activity, while weakness in technology dragged the large cap benchmark lower. The strong performance by mid caps in the fourth quarter reversed the third quarter pattern, which saw large caps lead the way as investors preferred the stability and more attractive valuations offered by larger companies. For the year, capitalization was not much of a driver of relative performance with large, mid, and small each generating returns of 16 – 17%.

In terms of style, value made a strong fourth quarter comeback to pull slightly ahead of growth for the year across market capitalizations. Gains for the Russell 1000 Value Index, Midcap Value Index, and Russell 2000 Value Index were 1.5%, 3.9%, and 3.2%, respectively, each ahead of their respective growth counterparts, which returned -1.3%, 1.7%, and 0.5% in the quarter. The relatively strong finish helped value end the year ahead of growth across all market capitalizations, by between 2% and 3%. The biggest driver of the strength in value, particularly late in the year, was the market-leading performance by the financial sector, the biggest weight in the value indexes, coupled with underperformance by the technology sector, the biggest growth sector.

The improved performance by international equities that began in the summer gathered momentum late in 2012, as the MSCI EAFE handily outpaced the broad U.S. market averages with a 6.6% return in the fourth quarter. Relative stability in Europe as the Eurozone continued to make progress toward fiscal and monetary integration, along with policy optimism and a weaker yen in Japan, were among the key drivers of this strength in foreign markets. Emerging markets also performed very well, returning 5.6% in the quarter as the growth outlook for China in 2013 has improved, consistent with fresh stimulus and the political leadership transition. The strong finish for international markets, supported by attractive valuations and less policy uncertainty, pushed both benchmarks ahead of the S&P 500 Index for the year, with the MSCI EAFE and Emerging Markets Indexes returning 17.8% and 18.6%, respectively, in 2012, compared to 16.0% for the S&P 500 Index.

Commodities Asset Classes: Down Fourth Quarter Leads to Flat 2012

Commodities were unable to build on solid third quarter gains as the Dow Jones-UBS Commodity Index fell 6.4% during the fourth quarter. The commodity index followed the equity market for the majority of the quarter, before diverging starting in late November, as stocks grinded higher in anticipation of a budget compromise in Washington while commodities fell.

Late-year weakness was concentrated in natural gas and agriculture. For the year, commodities were essentially flat as lower crude oil prices offset gains in natural gas, metals, and agriculture.

For commodity investors, fourth quarter performance was disappointing because of the tailwinds that were in place. Perhaps the biggest tailwind has been the Fed. After announcing another round of bond purchases in September, the central bank added more purchases in December. This stimulative monetary policy has not put meaningful incremental pressure on the US dollar (in no small part due to similar actions by other countries’ central banks), nor has it increased near-term inflation expectations, dampening the potential upward pressure on commodity prices, particularly precious metals.

The other tailwind for commodities that has not translated into gains has been the stabilization and early signs of a pickup in the Chinese economy. Chinese policymakers took a number of measures to stimulate their economy in 2012 and achieve a so-called soft landing, including reducing bank reserve requirements and interest rates. These efforts, combined with other targeted fiscal initiatives, have begun to take effect and show up in improving Chinese economic data. The recently completed leadership transition improves the growth outlook for the world’s second-largest economy as the outward focus is renewed.

Looking at individual commodities, energy was volatile during the quarter, but crude oil [Figure 6] and natural gas prices both ended roughly where they started near $92 per barrel (West Texas Intermediate) and $3.30 per btu (Nymex), respectively. The two commodities took very different paths to get there, with natural gas rising sharply in the first part of the quarter before forecasts for a relatively warm winter took it down sharply over the last six weeks of the year. Conversely, crude oil fell along with stocks in the early part of the quarter amid concerns on both the demand and the supply side, including the impact of Superstorm Sandy, before rallying back to breakeven as the equity markets moved higher, the growth outlook for both the United States and China improved, and tensions in the Mideast escalated. For the year, crude oil ended down 7% while natural gas rose 1%.

Looking at individual commodities, energy was volatile during the quarter, but crude oil [Figure 6] and natural gas prices both ended roughly where they started near $92 per barrel (West Texas Intermediate) and $3.30 per btu (Nymex), respectively. The two commodities took very different paths to get there, with natural gas rising sharply in the first part of the quarter before forecasts for a relatively warm winter took it down sharply over the last six weeks of the year. Conversely, crude oil fell along with stocks in the early part of the quarter amid concerns on both the demand and the supply side, including the impact of Superstorm Sandy, before rallying back to breakeven as the equity markets moved higher, the growth outlook for both the United States and China improved, and tensions in the Mideast escalated. For the year, crude oil ended down 7% while natural gas rose 1%.

Precious metals’ performance during the fourth quarter was particularly disappointing, given the additional stimulus provided by the Fed. Gold lost about $100, or 5.5%, to end the year at $1676 [Figure 7], while silver fell 12%. The US dollar was only marginally lower in the quarter as central banks around the world are engaging in similarly aggressive stimulus. But the gold thesis is broader than just the US dollar and includes emerging market demand and low interest rates, factors that remained supportive throughout much of the quarter. However, these factors had little impact on the precious metal, which trailed the equity market rebound in December. Gold still managed its twelfth straight annual gain despite the lackluster finish, ending 2012 up 7%. Industrial metals did not fare much better in the fourth quarter, as copper lost 3%, but still ended the year with a 6% gain.

Precious metals’ performance during the fourth quarter was particularly disappointing, given the additional stimulus provided by the Fed. Gold lost about $100, or 5.5%, to end the year at $1676 [Figure 7], while silver fell 12%. The US dollar was only marginally lower in the quarter as central banks around the world are engaging in similarly aggressive stimulus. But the gold thesis is broader than just the US dollar and includes emerging market demand and low interest rates, factors that remained supportive throughout much of the quarter. However, these factors had little impact on the precious metal, which trailed the equity market rebound in December. Gold still managed its twelfth straight annual gain despite the lackluster finish, ending 2012 up 7%. Industrial metals did not fare much better in the fourth quarter, as copper lost 3%, but still ended the year with a 6% gain.

Agriculture gave back all of its third quarter gains as the Dow Jones-UBS Agriculture Index lost 10% during the fourth quarter [Figure 8]. After sharp increases in grain prices over the summer due to the significant crop damage from the Midwest droughts, the supply picture in the United States became a bit less dire. International harvest prospects also improved late in the year, in Latin America especially, while key export partners including China increasingly balked at higher U.S. prices. These factors contributed to sharp declines in corn, wheat, and soybeans during the quarter of between 8% and 14%, although wheat and soybeans still posted double-digit gains in 2012, and corn rose 8%. The broad agriculture index still rose 4% for the year, despite the steep fourth quarter losses.

Agriculture gave back all of its third quarter gains as the Dow Jones-UBS Agriculture Index lost 10% during the fourth quarter [Figure 8]. After sharp increases in grain prices over the summer due to the significant crop damage from the Midwest droughts, the supply picture in the United States became a bit less dire. International harvest prospects also improved late in the year, in Latin America especially, while key export partners including China increasingly balked at higher U.S. prices. These factors contributed to sharp declines in corn, wheat, and soybeans during the quarter of between 8% and 14%, although wheat and soybeans still posted double-digit gains in 2012, and corn rose 8%. The broad agriculture index still rose 4% for the year, despite the steep fourth quarter losses.

Fixed Income – Taxable: Investors Continued to Favor Higher Yielding Fixed Income Over High Quality

The Barclays Aggregate Bond Index eked out a marginal 0.2% return in the fourth quarter, the sixteenth gain out of the past 17 quarters for the index. Fourth quarter gains brought the total return for the broad bond market index in 2012 to 4.2%, consistent with our forecast for low to mid-single-digit total returns initially noted in our Outlook 2012, published in November 2011, and reiterated in our Mid-Year Outlook 2012 publication.

The quarter and the year were led by more economically sensitive and higher yielding bond sectors, such as high-yield and investment-grade corporate bonds and emerging market debt, while high-quality bonds including U.S. Treasuries and MBS underperformed. Investors continued to be attracted to the additional income provided by these bond sectors relative to high-quality bonds, as expanded bond purchases by the Fed continued to push investors into higher yielding areas of the bond market. Treasuries fell marginally during the quarter, as the modest income component was not sufficient to offset the slight rise in yields. The 10-year Treasury yield increased 13 basis points during the quarter but remained low by historical standards near 1.8% [Figure 9] as the Fed, subpar economic growth, and benign inflation continued to exert downward pressure on yields and offset the slight improvement in the U.S. growth outlook that helped push yields higher in December.

The quarter and the year were led by more economically sensitive and higher yielding bond sectors, such as high-yield and investment-grade corporate bonds and emerging market debt, while high-quality bonds including U.S. Treasuries and MBS underperformed. Investors continued to be attracted to the additional income provided by these bond sectors relative to high-quality bonds, as expanded bond purchases by the Fed continued to push investors into higher yielding areas of the bond market. Treasuries fell marginally during the quarter, as the modest income component was not sufficient to offset the slight rise in yields. The 10-year Treasury yield increased 13 basis points during the quarter but remained low by historical standards near 1.8% [Figure 9] as the Fed, subpar economic growth, and benign inflation continued to exert downward pressure on yields and offset the slight improvement in the U.S. growth outlook that helped push yields higher in December.

High-yield corporate bonds and emerging market debt topped the major taxable fixed income sectors in the fourth quarter, as each generated solid returns of 3.3% based on the Barclays High-Yield Index and the J.P. Morgan Emerging Markets Bond Index, as investors were attracted to the higher yields these bond sectors provide. High-yield corporate bonds benefited from spread narrowing as corporate credit metrics continued to improve. Emerging market debt was buffeted by stronger economic growth outlooks, and less policy uncertainty (no fiscal cliff), in key markets in Asia and Latin America, which attracted investors to emerging market equities as well. For the year, emerging market debt topped all taxable bond sectors with a tremendous 18.4% return, followed by high-yield corporate bonds (+15.8%).

Among corporate bonds, longer term bonds fared a bit better as the Barclays Credit Long Index returned 1.3% in the quarter, compared to the 1.1% return for the broad investment-grade corporate benchmark, the Barclays U.S. Corporate Bond Index. Unhedged foreign bonds were hurt by low yields (extreme valuations) and a firm US dollar, losing 2.4% based on the Citigroup non-U.S. World Government Bond Index, although the hedged version of that index managed a respectable 1.2% return in the quarter as conditions in Europe stabilized and growth prospects in Japan improved related to the change in leadership. For the year, the hedged foreign bond benchmark returned 5.5%, while the unhedged index returned just 1.5%.

Among high-quality taxable bond sectors, Treasury inflation protected securities (TIPS) generated the best return at 0.7%, outpacing the marginal loss generated by U.S. Treasuries given the benefit of the inflation protection. MBS were the worst-performing bond sector in the quarter with a 0.2% loss, based on the Barclays U.S. MBS Index, as the modest income premium versus Treasuries failed to offset the impact of heavy prepayment activity. For the year, TIPS were the best-performing high-quality taxable fixed income sector, returning 7.0%, nearly 3% better than the Barclays Aggregate and well ahead of the meager 2.6% and 2.0% returns for MBS and U.S. Treasuries, respectively.

Fixed Income – Tax-free: Continued Municipal Bond Outperformance Though With Higher Volatility

Municipal bonds continued to perform well relative to their taxable high-quality bond counterparts with a 0.7% return in the fourth quarter, based on the Barclays Municipal Bond Index. Municipals continued to benefit from attractive valuations and a yield advantage versus U.S. Treasuries in outperforming the Barclays Aggregate Bond Index, although concerns about a potential cap on tax-exempt interest as part of tax reform did contribute to higher volatility in the fourth quarter and limit returns. Fundamentals are not particularly strong, with defaults starting to increase, though still at relatively low levels. But investors continue to enjoy an even more attractive tax benefit, which becomes more valuable at higher tax rates in 2013. The lower end of the quality spectrum fared best again this quarter, with the Barclays Capital High-Yield Municipal Bond Index returning 3.7% in the quarter to top all major bond sectors, taxable or non-taxable, bringing the 2012 return to a stellar 18.1%.

_____________________________________________________________________________________________

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Stock investing may involve risk including loss of principal.

All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

International investing involves special risks, such as currency fluctuation and political instability, and may not be suitable for all investors.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise and bonds are subject to availability and change in price.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Precious metal investing is subject to substantial fluctuation and potential for loss.

The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

Correlation is a statistical measure of how two securities move in relation to each other. Correlations are used in advanced portfolio management.

Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Quantitative easing is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

Materials Sector: Companies that are engaged in a wide range of commodity-related manufacturing. Included in this sector are companies that manufacture chemicals, construction materials, glass, paper, forest products and related packaging products, metals, minerals and mining companies, including producers of steel.

Energy Sector: Companies whose businesses are dominated by either of the following activities: The construction or provision of oil rigs, drilling equipment and other energy-related service and equipment, including seismic data collection. The exploration, production, marketing, refining and/or transportation of oil and gas products, coal and consumable fuels.

Health Care Sector: Companies are in two main industry groups—Health care equipment and supplies or companies that provide health care-related services, including distributors of health care products, providers of basic health care services, and owners and operators of health care facilities and organizations. Companies primarily involved in the research, development, production, and marketing of pharmaceuticals and biotechnology products.

Utilities Sector: Companies considered electric, gas or water utilities, or companies that operate as independent producers and/or distributors of power.

Consumer Staples Sector: Companies whose businesses are less sensitive to economic cycles. It includes manufacturers and distributors of food, beverages and tobacco, and producers of non-durable household goods and personal products. It also includes food and drug retailing companies.

Consumer Discretionary Sector: Companies that tend to be the most sensitive to economic cycles. Its manufacturing segment includes automotive, household durable goods, textiles and apparel, and leisure equipment. The service segment includes hotels, restaurants and other leisure facilities, media production and services, consumer retailing and services, and education services.

Telecommunications Services Sector: Companies that provide communications services primarily through a fixed line, cellular, wireless, high bandwidth and/or fiber-optic cable network.

Financials Sector: Companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, insurance and investment, and real estate, including REITs.

Industrials Sector: Companies whose businesses manufacture and distribute capital goods, including aerospace and defense, construction, engineering and building products, electrical equipment and industrial machinery. Provide commercial services and supplies, including printing, employment, environmental and office services. Provide transportation services, including airlines, couriers, marine, road and rail, and transportation infrastructure.

Technology Software & Services Sector: Companies include those that primarily develop software in various fields such as the internet, applications, systems and/or database management and companies that provide information technology consulting and services; technology hardware & equipment, including manufacturers and distributors of communications equipment, computers and peripherals, electronic equipment and related instruments, and semiconductor equipment and products.

_____________________________________________________________________________________________

INDEX DEFINITIONS

The Barclays Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays Capital High Yield Index covers the universe of publicly issued debt obligations rated below investment grade. Bonds must be rated below investment-grade or high-yield (Ba1/BB+ or lower), by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. Bonds must also have at least one year to maturity, have at least $150 million in par value outstanding, and must be US dollar denominated and non-convertible. Bonds issued by countries designated as emerging markets are excluded.

The Barclays Capital High Yield Municipal Bond Index is an unmanaged index made up of bonds that are non-investment grade, unrated, or rated below Ba1 by Moody’s Investors Service with a remaining maturity of at least one year.

The Barclays Capital Long Government/Credit Index measures the investment return of all medium and larger public issues of U.S. Treasury, agency, investment-grade corporate, and investment-grade international dollar-denominated bonds with maturities longer than 10 years. The average maturity is approximately 20 years.

The Barclays Corporate Index is an unmanaged index of publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. To qualify, bonds must be SEC-registered. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. The non-corporate sectors are Sovereign, Supranational, Foreign Agency, and Foreign Local Government. Bonds must have at least one year to final maturity, must be dollar-denominated and non-convertible, and must have at least $250 million par amount outstanding. Bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade.

The Barclays Mortgage-Backed Securities Index includes 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal Home Loan Mortgage Corporation (FHLMC), and Federal National Mortgage Association (FNMA).

The Barclays Municipal Bond Index is a market capitalization-weighted index of investment-grade municipal bonds with maturities of at least one year. All indices are unmanaged and include reinvested dividends. One cannot invest directly in an index. Past performance is no guarantee of future results.

The Citigroup World Government Bond Index is a market-capitalization-weighted index consisting of the government bond markets. Country eligibility is determined based on market capitalization and investability criteria. All issues have a remaining maturity of at least one year.

The Dow Jones – UBS Commodity Index is composed of futures contracts on 19 physical commodities. Unlike equities, which entitle the holder to a continuing stake in a corporation, commodity futures contracts specify a delivery date for the underlying physical commodity.

The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for traded external debt instruments in the emerging markets, and is an expanded version of the JPMorgan EMBI+. As with the EMBI+, the EMBI Global includes U.S. dollar-denominated Brady bonds, loans, and Eurobonds with an outstanding face value of at least $500 million. It covers more of the eligible instruments than the EMBI+ by relaxing somewhat the strict EMBI+ limits on secondary market trading liquidity.

MSCI EAFE is made up of approximately 1,045 equity securities issued by companies located in 19 countries and listed on the stock exchanges of Europe, Australia, and the Far East. All values are expressed in US dollars. All values are expressed in US dollars. Past performance is no guarantee of future results.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005, the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey, and Venezuela.

Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell Mid Cap Value Index offers investors access to the mid cap value segment of the U.S. equity universe. The Russell Mid Cap Value Index is constructed to provide a comprehensive and unbiased barometer of the mid cap value market. Based on ongoing empirical research of investment manager behavior, the methodology used to determine value probability approximates the aggregate mid cap value manager’s opportunity set.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not

an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit